Egypt, April 29th 2025,

The IMF is showing some optimism for Egypt ; Kuwait to convert deposit into investments ; Treasury bill’s yield will decline slowly !

Welcome to MENA MARKET LAB !

We aim here to bring you regular updates on factors and events impacting financial markets in the Middle East and North Africa region with an accent on foreign exchange and rates.

We also aim to bring reflections on certain topics and subjects, close to recent events, which we think are worth stopping on .

Thank you for your attention !

The IMF is showing some optimism for Egypt ; Kuwait to convert deposit into investments ;Treasury bill’s yield will decline slowly !

Five months ago, the corporate and financial world in the US openly rejoiced after the outcome of the US elections. Animal spirits were to be unleashed, the dollar to reign supreme, equity markets to the sky ! Today, it is hard to find an article that doesn’t predict the end of the dollar hegemony, the abyss for the greenback and the exit from all US markets. Neither Europe nor UK seem to be in a much better place. Growth perspectives for those two are even lower than for the US. China has its own place. California has surpassed Japan on the GDP rankings ! True , US equities are still expensive , but all that money cannot be parked in European markets nor EM. Exit treasuries , fine but where to go ? Buy gold, crypto , Greenland ? It seems that just as calls for the forever lasting dominance of the greenback five months ago were a bit extravagant , so are those for its immediate demise today ! Amusing to read a columnist in the FT today writing she predicted what is happening today.. in 2019 ! Maybe we should try Tarot cards’ readings !

Growth prospects, the IMF , unlike for most other countries, has raised its growth forecasts for Egypt from 3.6 to 3.8 % for 2025 and from 4.1 to 4.3 % for 2026. It is citing the manufacturing sector, trade and tourism as the three key pillars to support economic growth.

The IMF has also lowered its year-end FX forecasts for the Pound from 50.6 to 49.9 in 2025 and 52.3 from 54.70 in 2026 !

The real estate sector is also showing signs of robust activity although not comparable with what is seen in the Gulf. Early in the year, transactions across all sectors were up 12% y/y.

Egypt’s statistic agency , the CAPMAS, reported the annual unemployment rate dropped to 6.6 % in 2024 from 7 % in 2023. A few things to note, unemployment among the 15-29 years of age dropped 1 % to 14.9 %. Unemployment for intermediate, higher and university level education dropped to 18.7 % from 20.3 %. The total labour force increased to 32.041 million individuals from 31.149. Last before I bore you, labour force participation is higher in rural areas, unemployment higher in urban areas. Overall economic activity for those above 15 rose to 44.2 % from 43.4. Still a large pool of potential workers to tap !

Egypt and China are discussing a development swap scheme where part of Egypt’s debt would be converted into interest free loan to finance key development projects as was quoted Chinese ambassador Mr Liqiang. Mr Liqiang highlighted that Chinese companies are increasingly interested to expand in Egypt, that Egypt is a BRICS member and a partner of China’s Belt and Road Initiative !

Kuwait , the joint Kuwait-Egypt Cooperation Council meeting and the Investment and Business Forum was held last week. It was reminded that Kuwait’s investments in Egypt amount to 20 bn $ . 1500 Kuwaiti companies are invested in Egypt. Trade has room to grow with Egyptian exports on average OF an annual value of 367mn $ while imports from Kuwait at just 71mn $.

Very importantly, there are advanced discussions for the conversion of 4 bn $ of deposits held with the CBE into investments in the country. Half of it could be invested before year end. That conversion would take 4 bn $ of Egypt’s liabilities.

This comes after :

· The EU-Egypt deal for 4 bn euros

· Decision taken by Egypt to fast-track Saudi investments

· Recent talks with Qatar for the investment of up to 7 bn $.

Similar real estate development projects like the one signed with the UAE in 2024 are in discussion though not as sizable.

Egypt has set ambitious targets for FDI in the coming years, 60bn $ of which 65 % from the private sector , and to increase the value of exports to 145 bn $. In 2024, FDI reached 46.6 bn $.

Market wise,

We are not going to get any Monthly Statistical Bulletins for a while as we had 3 in a row after the MPC meeting . So let’s try to make the best out of it.

The CBE only started to report as a footnote the positions held as collateral for funding since the July report.

NB : seems to be some small discrepancies in CBE’s reporting as numbers do not totally add up.

· Collateral has a share of foreigners has been growing regularly.

· Last I heard, the spread for such type of funding is 200-250 bps over SOFR . Make the calculation, that is a very decent source of revenues.

· Offshore investors seem to have had a peak exposure in October and then eased down.

· The drop in December is quite steep but then again , it is year-end so massage the books and materialize some profits.

· Secondary market activity for the offshore has been mixed. February saw them selling for 1.1 bn $ worth of bills ( if you sum up Foreigners and Arab investors) ; March saw +4.2 b $ but remember there were huge maturities in March 2025 coming from the massive auctions of March 2024 following the devaluation , over 26 bn $ ). And according to local sources, that inflow is not reflected in FX moves and volume , hence most likely that buying was just to replace matured papers.

· Although April is not over, foreigners sold for 2 bn $ after Trump’s tariffs day. And have gone quiet since. It doesn’t help that we had Easter weekend and Thursday 24th closed.

One word on CD’s issuances by state-owned banks : following the CBE’s rate cut, the two largest state-owned banks in Egypt have lowered the rates they offered on fixed rate 3 year CD’s by 2 %. One year CD’s at 27 % are over. The 3 year will now offer 28-23-18 % for the 1st, 2nd and 3rd year from 30-25-20 %. Effective Sunday 27th.

This touches a topic quite sensitive for the IMF : they noted so in their 1st and 2nd reviews of the EFF, citing that the re-introduction by state-owned banks of CD’s with yields above the official prevailing rates as “ distorting and with possible negative implications for the financial health of the banking system and for the development of robust market-based transmission mechanism for the monetary policy”. The IMF went further in the 3rd review by insisting on the government to hire international consultants to advise on proper governance for state banks.

Remember previously the concerns of the IMF of the overdraft facility of the CBE for the MoF and other government entities. Bit of a gas factory.

Those high CD’s are often issued at times of forex crisis to counter dollarization. According to my well informed and knowledgeable source, those CD’s are attracting most incoming remittances.

It seems that the FX risk is still very much present in the mind of authorities and will take as little risk as possible with it.

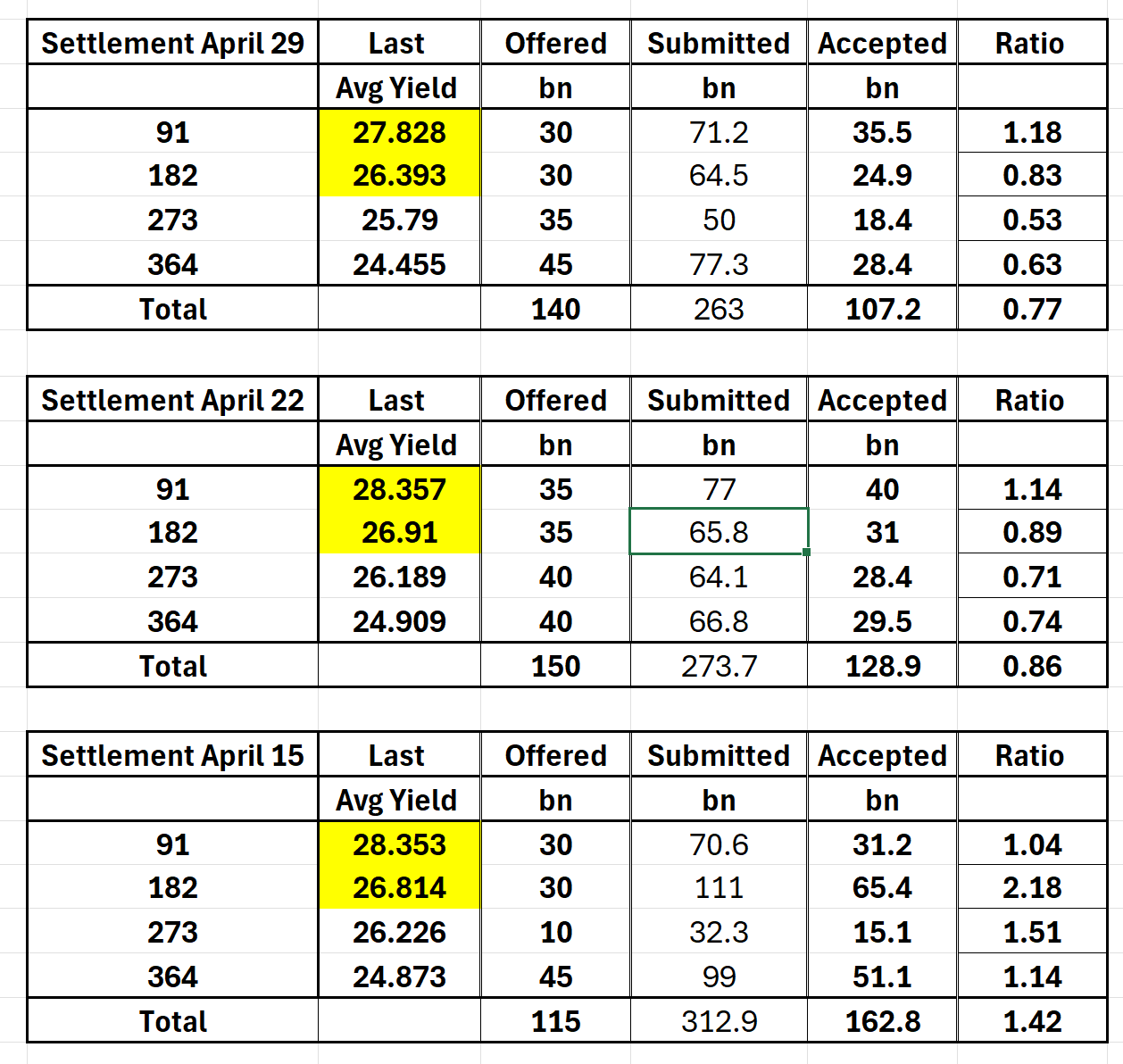

· Recent issuances have had a mixed reception. See the two tables below. By settlement date and by tenor.

· We will not show the bond auction as they have attracted minimum interest lately.

· For the Treasury bills, yields are just marginally lower and that ought to be expected.

As was underlined by my friendly source :

· The treasury bill curve is normally above the corridor rates, ie, the official rates with the lower boundary now at 25%. I’ll come with a chart shortly.

· Treasury bills carry normally 20 % withholding tax.

· Local banks can place with the CBE at 25 % on a daily basis. If you compound , bills cannot match. Do the math : 25 % compounded daily and add the 20 % tax to see what bills should pay to match !

· This is something we underlined many times, it is not very attractive for local banks.

· It is though for offshore investors who cannot access that facility hence the reason for the bill curve to be lower.

· Offshore interest seems to be diminishing in that volatile environment.

· Remember the sell-off when Trump aired his desire to make a new “ Mar a Gaza “, which Israel is doing under the cover of the tariffs’ storm which is taking all media attention so Gaza fell in the back pages.

· Then came yesterday calls from Trump asking for Egypt to waive Canal fees for US ships. He probably believes that it is Americans who built the Suez Canal, who else ! So Egypt will have to deal cautiously with that new threat !

· Spot Usd/Egp is trading lower : 50.81 was yesterday’s daily average. One has to go back before Liberation Day to see those levels.

· NDF wise, 1 year fell to 59 mid from 59.80 since mid April , a fall of about 1 % in implied yields. Which is matching 1 year bill with tax .

In conclusion , we feel that official rates will decline faster than bill rates. With offshore interest diminishing, locals will need to be compensated with higher rates.

Although it is virtually impossible to predict what can come out of the White House, I would venture that we could have seen the worse of the shocks.

In that context, Egyptian Treasury bills still look like a good position to have !

Thank you

DC