Egypt, June 2nd 2025,

Egypt’s PMI released later today; another 20 bn 5yr bond today ? Energy will keep impacting the trade balance. Bills, no time to quit !

Welcome to MENA MARKET LAB !

We aim here to bring you regular updates on factors and events impacting financial markets in the Middle East and North Africa region with an accent on foreign exchange and rates.

We also aim to bring reflections on certain topics and subjects, close to recent events, which we think are worth stopping on .

Thank you for your attention !

Nile delta !

Egypt’s PMI released later today; another 20 bn 5yr bond today ? Energy will keep impacting the trade balance. Bills, no time to quit !

First,

So far, Trump hasn’t criticized Israel too much, he just wants to see if they could stop that whole situation as quickly as possible. The US still supplies Israel and US Homeland Security Secretary Kristi Noem (and her makeup crew) visited PM Netanyahu in support. European countries who have recently criticized Israel and suspended trade talks or else have been branded antisemite by Bibi and accused of emboldening Hamas. Unfortunately Hamas is a creation of the first intifada and doesn’t need Europe’ support and just like the US turned a blind eye to the Islamist Mujahideen in Afghanistan after the Soviet Union left, so did Israel with Hamas , favouring them over the PA. Netanyahu was Prime Minister when Yahya Sinwar was released from jail in a 1000 prisoner swap for one Israeli soldier, Gilad Shalit in 2011, Divide to rule so a two-state solution would be impossible. Former Israeli Prime Ministers Ehud Omert ( who resigned and served prison time for accepting bribes ) and Ehud Barak heavily criticized Netanyahu recently. Difficult to see an end to this war with the same actors in place.

Now,

Interesting article in the Economist this week pointing the recent winners and losers in the recent Middle East’s turmoil. Rising stars, Syria and Lebanon, declining stars Egypt, Jordan and the PA ( Palestinian Authority ) of President Abbas, still president since no elections have been held since 2009. The article points that during Trump’s first-term visit in Riyadh , President Sisi was invited by the hosts to join. No such thing this time. The article goes on that the Egyptian President attended an Arab League Summit in Bagdad which had few heads of state present. In contrast, Syria’s President Ahmed al-Sharaa, who was also supposed to attend, didn’t , apparently for security reasons ( Iranian militias ) and was whisked in Riyadh where the “ great guy” was met by the US President.

Sometimes appearances are important but on one side we have Egypt and 110 million inhabitants with a stable situation , could be better and some work to do , and the other two countries in great disarray where everything has to be done and where much can go wrong very quickly. There might be great opportunities , not for the fainthearted though, but Egypt as a stable country is vital for the region.

Worth to remind, the Ministry of Finance has signalled its intention to offer stakes in 11 state-owned companies next fiscal year, 2025/26. Five of those are affiliated with the Armed Forces. Also mentioned before, Egypt’s Sovereign Fund ( TSFE ) is working to “ clean up” those companies to get them ready for listings.

Energy, that should help Egypt. OPEC 8 ( the countries who agreed to voluntary production cuts in November 2023) announced on Saturday another increase in production for July , 411k bpd, the same increase that had been agreed for May and June. The previous day, at the 39th OPEC and non-OPEC ministerial meeting, the communique emphasized unity, commitment and maintained all the production cuts implemented in October 2022 and April 2023 which amount to 3.7mn bpd.

This against a backdrop where some producers included in that group of 8 have constantly exceeded their quotas : Kazakhstan, Iraq and UAE.

As the IMF has concluded its visit for the 5th review, the final report is expected before the end of the fiscal year ( June 25 ), a few key points :

· Efforts to modernize and streamline tax and custom procedures welcome but more needs to be done. We have seen the result of this recently with a jump in tax revenues with a constant perimeter.

· Privatisation and strengthening the private sector, ensure a level playing field .

The current account and trade balance will remain under pressure, in great part due to the energy sector . The government is in talks with energy and trading companies to buy 40 to 60 cargoes of LNG as the energy crunch is worsening ahead of the summer. Last week, the President was directing the government to take every measures to ensure stable electricity flow. Data from S&P Global Commodity Insight shows that Egypt bought 1.84mio tons of LNG so far this year, 75 % of the total of 2024. 40 new cargoes would be 1 mio tons and the cost could reach 3 bn $.

According to Reuters, Egypt plans to divert 7 % of the annual Nile River quota rerouted from the fertile delta for residential units, commercial zones , yacht marina and a free economic zone. Does Egypt need a new yacht marina ?

Last, several days ago, Egypt and the EU announced the launch of a 2 bn $ investment guarantee plan for key sectors such as energy, infrastructure, water, agriculture and climate change with the aim to boost activity and investment in the private sector.

Market wise,

· Spot continues to ease down, little by little : 49.70 today compare to 49.90 a week ago. NDF follows lower , no more no less should I say, 1 year around 58.30 from 58.50.

· Although we don’t have yet the most recent Monthly Statistical Bulletins from the CBE, the last one is dated 5th of February , a bit of digging in EGX reports reveals some interesting points with a bit of caution on my side on the data.

· Correct me if I am wrong but I am sure there are enough young graduates in Egypt who could take a job at the CBE or the MoF to work on numbers. The last report from the MoF on the outstanding of treasury bills dates from August 31st 2024 !

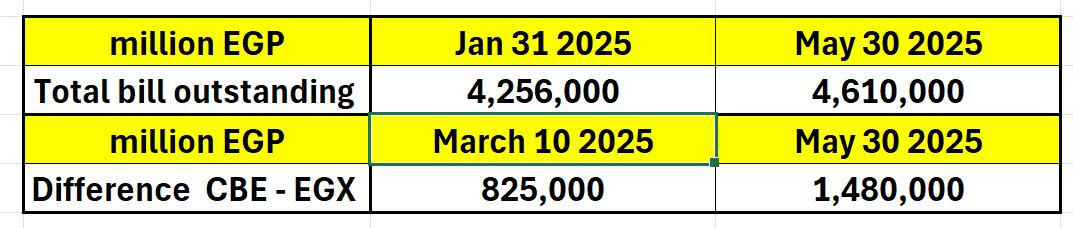

· The total amount of outstanding bills would have increased by 360bn EGP or about 7 bn $ from the end of January till now.

· What is more interesting is that the amount of bills issued outside the auctions ( private placement and all) has increased by 655bn EGP. I get to this number by adding on one side all the amounts accepted during the regular auctions of the CBE twice a week and the amount outstandings as reported by EGX per maturity.

· It seems also that the bulk of this increase has happened in the run-up to the very large amount of maturing 1year bills in March 25 ( bills that had been bought after the devaluation in March 2024).

· It is probably fair to assume that the shares of foreign investors might have increased a bit over the past few months but not that much looking at secondary market data, challenging though to assess from the auctions. So above the 15 bn $ mark of January but most likely below the 19 bn $ in July.

Source : CBE,EGX.

· Secondary market activity has been fairly muted in May . In terms of volume , only February was quieter so far this year. “Arab “ buyers have been the most constant buyers so far this year.

Source : EGX

· On the local bond side last week , the 5 year bond attracted attention with again a single bidder for 20 bn EGP of 5 year , this time at a slightly lower rate, 19.25% from 19.98 %, even though later in the week, the yield edged back up closer to coupon rate , 19.98 %. But unlike the previous week, where the bonds changed hands quickly , so far, just 300mn EGP have been sold. Two weeks ago , a likely scenario would have seen a primary dealer ( local branch of international bank ) taking the whole 20bn of 5 year at the auction and a few days later those 20 bn were sold to an “ Arab” name : that “Arab” name based in the Gulf could have sold it or acted for an international client as they are themselves custodians for some large international custodian banks. Again all that information is readily available from the daily EGX reports. So far, despite an international name offering via broker a slice of those 20 bn, little has changed hands. Let’s see what happens today.

· Treasury bill side, a bit of a mix bag . The most popular this week was the 3mth with a cover ratio of 1.2. All accepted yields except the 3mth were a touch higher.

· As we said before , the math despite the last rate cut still doesn’t really work for local names . Fixed rate weekly deposit auctions are at 24.50 %. Compound that and compare to even the 27.98 % 3mth bill rate including withholding tax.. For foreigners who don’t have this option, it is different and the withholding tax is lower for most ( 10 to 15% ).

Wind turns ! Several weeks ago, I was citing the recommendation of one top US investment house : they were exiting a basket of carry trade positions including Turkiye, Egypt , Nigeria and a fourth one citing increased risks and lack of clarity in regards to Trump’s announcements. Recently they have called for new positioning on the bill side, unhedged and even leveraged while they are also seeing value in Turkish bonds.

The rule of the games are simple. High yield carry trades in countries where history of run on FX liquidity are well known requires patience and a well defined time horizon. Some will hedge bill positions with a 25 or 30 % NDF hedge . That guarantees a certain spot but not FX liquidity . And then if there is 15 or 18 bn $ held in foreign portfolios, there isn’t liquidity for 25 or 30 % of that in the NDF market.

So yes, it is a good position, being long Egyptian treasury bills. I wouldn’t go as far as the 5 year bond. True , it is a bit frustrating at time to witness the slow speed the government is taking to implement things. Taking the example of those 11 state-owned companies to be privatized. To be listed in 2025/26 means it can be June 2026 ! But there again, if they were doing all the right things, yields wouldn’t be at 27 % !

I will finish with a good call I heard in one of Joe Rogan’s podcasts, guest was Bono. He was talking about fighters , boxers , MMA or else who want to quit or think to stop and saying , “ if you are thinking to stop, you are already out of the fight , so exit now ! “. And as an image, take a boxer who thinks to quit while he is climbing on the ring to face Mike Tyson ..Big mistake!

The analogy would be , if you think to square your bill position, just do it now ! Now is not the time though !

Thank you

DC