Egypt, March 25th 2025,

Fuel prices’ increase to come soon . Gaza’s ceasefire was just a short lull. Foreign investors hungry again.

Welcome to MENA MARKET LAB !

We aim here to bring you regular updates on factors and events impacting financial markets in the Middle East and North Africa region with an accent on foreign exchange and rates.

We also aim to bring reflections on certain topics and subjects, close to recent events, which we think are worth stopping on .

Thank you for your attention !

Nubian pyramids

Fuel prices’ increase to come soon . Gaza’s ceasefire was just a short lull. Foreign investors hungry again.

The world is getting smaller and will keep shrinking. For some like Andras Schiff ! Mr Schiff ,71, is an eminent concert pianist , born to a Jewish family in Budapest and who witnessed the tragedy and horrors of the Holocaust. He has been boycotting strongmen’ regime and is refusing to perform in Russia as well as in his native Hungary since 2010. He says he will no longer perform in the US because of Trump’s policies. Although he is not the only artist or musician to take such a position he is very conscious that his and their boycotts will not have much of an impact.” In history, one has to react or not to react “. It is all very honourable. He performed though earlier this year in China. And a word on Gaza .

Egypt..

Along with commitments taken with the IMF’s EFF package , Egypt is set to raise the price of retail fuel products twice before the end of 2025. To bring them to cost of recovery.

Sources say that the Fuel Automatic Price Committee ( FAPC) sets the actual cost of octane 95 at 35 EGP per litre, price stands today at 17. Gas cylinder costs 400 EGP while price is 150. Few other examples ( actual cost – today’s price ) : diesel per litre ( 20-13.5 ), octane 80 ( 16-13.75 ) and octane 92 (18 -15.25). So prices will have to be raised between 20 % to more than 100 %. Assuming actual costs remain identical ( price source, Ahram online).

The same sources claim that the government spends daily 200 mio EGP on gas cylinder subsidies and 750 mio on diesel fuel.

For that reason, most analysts, after the sharp drop in inflation seen 2 weeks ago, see inflation stable to moderately higher by year end. The IMF has a target of 16.6 % for the end of Fiscal Year 2024-2025, that is end of June ( last CPI was 12.8 % y/y).

Inflation as well as record high gold prices is pushing Egyptian families to make choices as Ramadan, Eid El-Fitr and Mother’s Day converge. Gold jewellery gifts are a tradition but in light of sky rocketing prices, focus will be more on clothing and appliances.

Positive news, Egypt’s primary surplus hit an all time high with 330 bn EGP for the first eight months of the year, thanks to tax revenues up by 38.4 % y/y.

Investment wise, Siemens Gamesa will build a 500 MW wind farm in the Gulf of Suez.

Regionally, things get trickier again. Israel has been increasing bombardments and operations in Gaza and it looks like the ceasefire is a dead thing. Late Saturday, the Israeli cabinet approved a proposal to set a new agency to expel Palestinians from Gaza. We could see the writing on the wall when the government approved the re-appointment of Itamar Ben-Gvir as national security minister. Mr Ben-Gvir resigned mid-January to protest the ceasefire agreement. A follower of extremist rabbi Meir Kahane, Mr Ben-Gvir was exempted from conscription due to his extremist background. If it was just up to him and Finance Minister Bezalel Smotrich, Israel would simply annex all the West Bank and Gaza and displace whoever is there.

Mr Trump himself signalled that the second phase of the ceasefire was dead. The US and Israel would have discussed with three African governments to “ welcome” Palestinians : Sudan, Somalia and Somaliland. The fact that Sudan is in the middle of a civil war and famine is ravaging part of the country doesn’t seem to be a problem.

That also means that with Israel acting as if there was no ceasefire, Houthis in Yemen are not going to let down their targeting of ships and tankers attempting to go through the Suez Canal. Hence, for Egypt, Suez Canal receipts will not recover for now : for 2024, that translated into a loss of revenues of 7 bn $ , only compensated by a surge in foreign remittances.

Market wise,

· The spot price has been fluctuating between 50.48 and 50.65 using the daily weighted average as published by the CBE.

· On the offshore market, NDF, prices have fallen quite a bit since last post on Egypt on the 13th, 1 year falling to 58.40 mid from 59.35 which, with roughly stable spot prices, gives the implied yield at 21 %, a fall of close to 2 % , roughly in line with the fall on treasury bill yields.

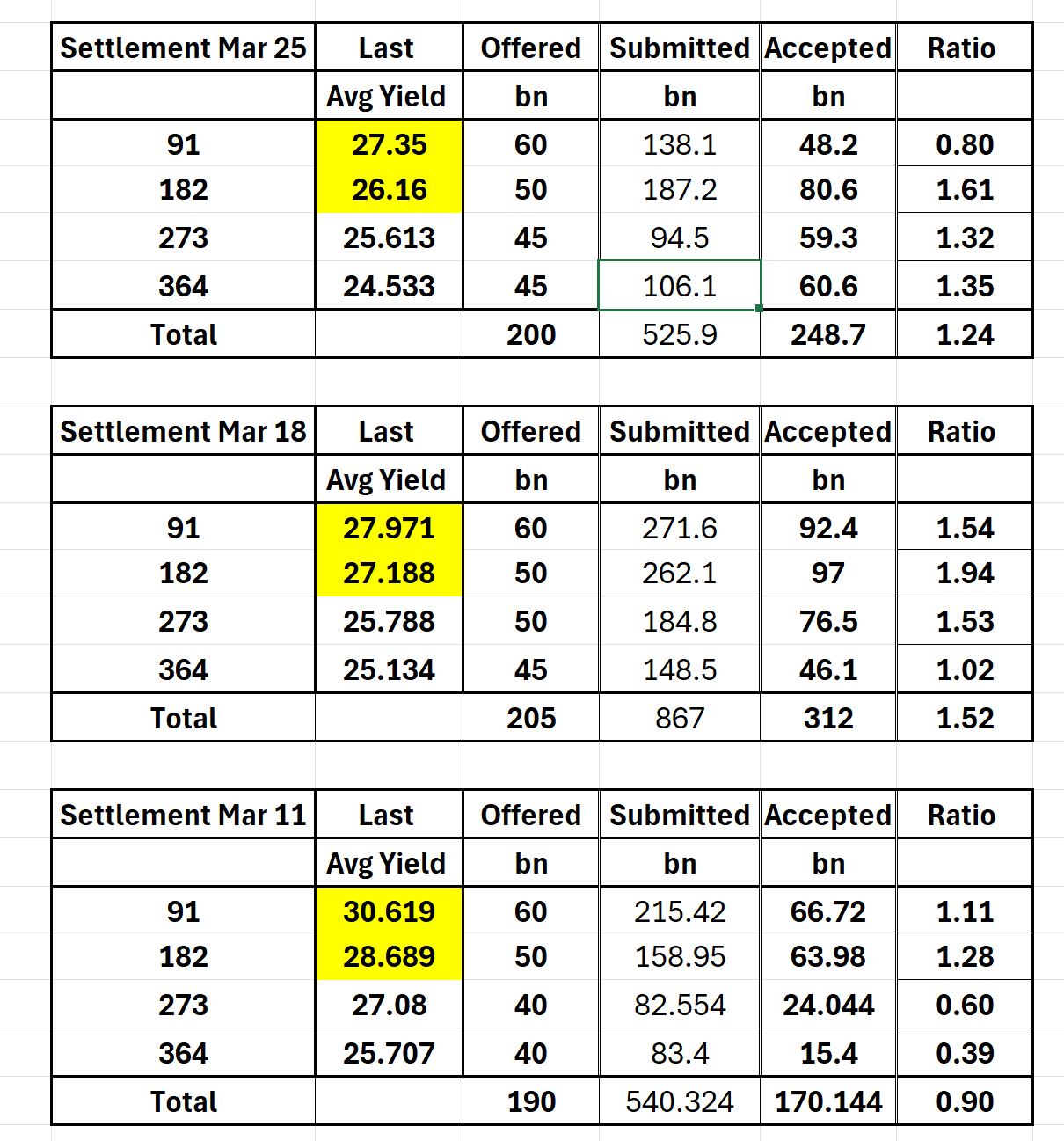

· Auctions, with yields coming down the enthusiasm is starting to moderate. See table below. Keep in mind that the auctions with settlement 11th of March were the week before the release of last inflation numbers ( March 10th ).

· From pre-inflation release to now, the accepted yield on the 3 month has come down by over 3.3 %, on the 6 month by 2.5 % and 1.2 % on the 1 year.

· On the bond side , accepted bonds have fallen quite a lot , even though, issued amounts are much smaller than for the bills, despite unchanged yields.

· On the secondary market, activity has been very sustained with peak volumes on settlement dates .

· Data complied from EGX . Starting the day after the last inflation numbers’release.

· Foreigners have been net buyers of close to 3.3 bn $ equivalent while Arab entities have purchased slightly over 600 mio $.

Markets and most analysts expect a rate cut at next MPC meeting in April. 2 to 3 hundred basis points ( the mid official rate is 27.75 % ). At this stage, as was signalled before, real interest rates stand at close to 15 %. There is room to go. And one thing is sure, Egypt is not going to have one of those moments like Turkiye had last week ! Other things can happen. But for now with a quasi-stable FX rate, yields remain very attractive !

Thank you

DC