Welcome to MENA MARKET LAB !

We aim here to bring you regular updates on factors and events impacting financial markets in the Middle East and North Africa region with an accent on foreign exchange and rates.

We also aim to bring reflections on certain topics and subjects, close to recent events, which we think are worth stopping on .

Thank you for your attention !

No news, good news ! Egypt will benefit for a more benign environment !

First,

How can you convince people that the system is not rigged against them ?

Much ink has been spilled recently in UK over utility , rail companies and the likes. For poor services and exorbitant prices. The latest to make headlines, Thames Water , supplier of water and water treatment for a large part of South England. By the way, Thames Water has China and Abu Dhabi as 10% investors each . Bills this year went up by 50 % for a water I wouldn’t and don’t drink . The company has been affected by chronic mismanagement, under repair and maintenance and let’s be honest , a network that hasn’t really been modernized for decades.

In March 2025, the company had less than 40mn pounds in the bank, 20bn in debt and was looking at bankruptcy. Talks abounded of private equity taking over. They finally secured a 3bn pounds loan from hedge funds( guess what will happen if they can’t repay ) at a modest rate of 9.75 % ( Egypt’s yield on 7 year bonds ) !! Meanwhile, the top management of the company insists on paying “ retention payments “ worth millions of pounds to its top managers; they disguise it as retention so it is not qualified as bonuses for a virtually bankrupt company.

How does that sound to Mr and Mrs Smith ! “ I “ raise your bill by 50 % this year and another 25 % for the next 7 years and pay “ myself” a huge amount of cash. Sounds like 2007/08 !

Egypt,

Trade deficit, the official agency for statistics ( CAPMAS) reported a narrower trade deficit for February 2025 compared to a year ago, at 2.33 b $ from 3.28 bn, or a 29 % decline. The value of exports rose by 24 % (garments, petroleum products, agro-industrial products ) while the value of imports decreased by 1.4 % . Interesting to note that the government has adopted a more realistic target for exports by 2030, to 115.8 bn $ from a previous target of 145 bn $ made early in 2024. And imports at 105 bn $. So between the lines, a trade surplus of over 10 bn $ : ambitious target as in 2024, the trade deficit reached 37 bn $.

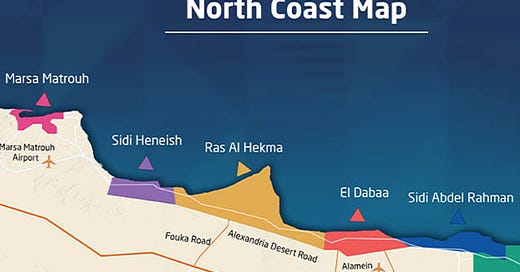

Arab investments in Egypt surged to 41.5 bn $ in FY 2023/24 as reported again by CAPMAS , a very significant rise from 7.3 bn $ for the previous year : the number is driven by UAE’s investment in the Ras El Hekma development deal.

Remittances, the CBE reported that foreign workers’ remittances increased by 72.4 % for the period running from March 2024 to February 2025 to 32.6 bn $. The figure for February 2025 doubled from February 2024 to 3 bn $. Post devaluation effect ! CAPMAS also reports 11.1 million Egyptians living abroad .

On Wednesday , Ms Rania Al-Mashat, Minister of Planning and International Cooperation, met Ms Ivanna Vladkova from the IMF on the side of the 5th review of the EFF. Will be assessed macroeconomic trends, structural reforms and external financing needs. Also to be reviewed, progress on the Nexus for renewable energy projects . The minister highlighted debt for swap deals with Germany, China and Italy . The IMF reaffirmed its commitment for continued support. It is expected that the review will be completed before the end of the fiscal year ( late June). Comments on governance, relations between the CBE, the government and the banking sector will be carefully scrutinized.

Regional stability as epitomized by the triumphant tour of the US President in the Gulf and a potential deal with Iran will be beneficial for Egypt. As well as lower energy prices.

Market wise,

Everybody seems to be breathing again with the US-China pause. Equities are up, volatility is down. Oil rallied but then lost some ground on talks of a deal with Iran .

A few things on the bill market :

· Last Monday saw a large volume transacted on the secondary market, “ Arab” names buying slightly over 39.6 bn LE worth of treasury bills/bonds . A closer look ( all available in EGX report of the day ) shows that 38.995 bn of that was bought by the subsidiary of a large Abu Dhabi bank , the supply came from the largest domestic player, National Bank of Egypt. Rumour has it as collateral for repo financing .

· Besides this transaction, activity was quite subdued with low volume and modest offshore interest, still buyers of roughly 10 bn LE though.

· Auctions : the 6mth paper had a lot of success last Thursday with 148 bn LE submitted for 35 bn offered and later accepted 103 bn. This saves the overall auction for settlement May 20th as the 1 year was poorly received ( 0.2 ratio ) and today’s 3m and 9m got a below par reception with yields more or less unchanged. Meaning yields still matter a lot ! The coverage for the 2 and 3yr bond auction remains poor, around 20 %.

· A well respected US name has been recommending buying 3mth bill with some leverage ( 28.56 % today ) or 9mth ( 26.638 % ) to go over several MPC meetings. Another recommendation but goes without saying : no FX hedge ! What would be the point to buy bills at 26.5 or 28.5 % and hedge it with NDF around 21 % , assuming one will pay 10 or 15 % of withholding tax! No point at all !

· Last, FX has been steadily going down : at 50.1083 today, it is the lowest print for the currency since early December of last year.

· Thursday, as well as the successful 6 month auction, the FX saw decent inflows coming in, around 400 mn $.

Short one today but unless dramatic news from the White House, the winds continue to be favourable for Egypt. Thursday is the coming MPC meeting and I wouldn’t be surprised to see the CBE cut rates by 100-200 bps even though inflation has ticked up last month and the IMF advised against a too rapid rate cut cycle.

Thank you

DC