Welcome to MENA MARKET LAB !

We aim here to bring you regular updates on factors and events impacting financial markets in the Middle East and North Africa region with an accent on foreign exchange and rates.

We also aim to bring reflections on certain topics and subjects, close to recent events, which we think are worth stopping on .

Thank you for your attention !

Oil, Trump , Netanyahu , Saudi Arabia, Kuwait and Morocco ..

First,

Since retaking the White House , President Trump and his former chum have been busy gutting any kind of independent agencies in charge of oversight. Not a good time to be a whistle blower, you are on your own. One we mentioned before, the PCAOB : Public Company Accounting Oversight Board. It was created in 2002 to oversee accounting professionals and auditing companies in the wake of the Enron and WorldCom’s scandals. Before that , that profession was auto-regulating. A bit like Pablo Escobar running his own jail. The profession ultimately welcomed it as it was setting higher standards and transparency. The Republicans and the President want to get rid of it. Back to Escobar !

Another interesting line : US CEO’s are the highest paid in the world , shareholders rarely reject their packages. Tough US disclosure rules mean there is a lot of details : salary, options, bonus, cars, flights, security services, pets and all. No point to comment on the widening gap between CEO’s and the workers down the line, but packages don’t always reflect the performance of the company : Warner Bros Discovery took home 52mn $ ++ , up 4 % while shares are down 60 % since the merger, bond rating cut to junk and 11 bn $ losses. Now the SEC and Congress want to do away with that “ excess of reporting “. Who is the GOP working for !

Now,

Funny how things change quickly ! From the moment I started on this post yesterday to now !

Israeli Prime Minister’s cabinet survived a vote to dissolve the Knesset amid the crisis to draft orthodox Jews into the army . As the cost and weight to defend the country is increasing , many want the Haredim to be conscripted. Ultra-orthodox parties inside Netanyahu’s coalition vehemently oppose. For the record when, in 1948, Israel’s first Prime Minister Ben Gurion exempted ultra-orthodox from the army, they were just a few thousands. Jewish men who study the Torah full time in seminaries are exempted from enlisting until the age of 26 and by then they are over the limit. Now they account for 13 % of the population or 1.3 million people.

What is important with this is that it reinvigorates Netanyahu. His coalition survived for now. And as US-Iran’s negotiations are getting tensed, rumours fly around that Israel could go alone and target Iran. Some voices in US circles say that Israel has the capacity and is ready to go. Whether the US would support is another story but we can be sure that they had plenty of time to rehearse some plans.

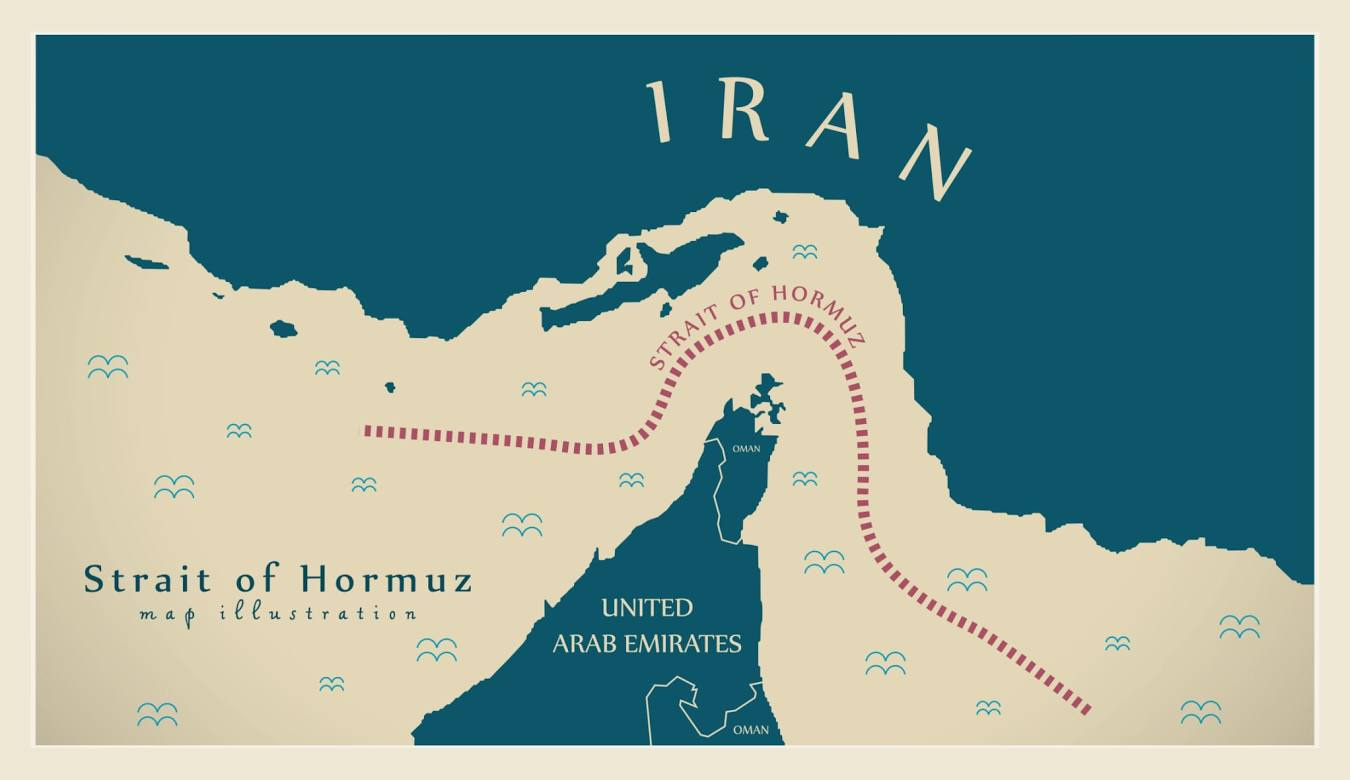

To add a bit of spice, Trump is reported to have ordered US personnel to leave Baghdad. Another of Trump’s statement, Iran cannot have nuclear weapons. And the UK Maritime Trade Operation has issued a warning of potential escalation in the Arabian Gulf and the Strait of Hormuz !

When making presentation in the past on GCC , the first thing we say about the Saudi Riyal is that it is a proxy vehicle for regional instability and oil !

As a consequence of the escalation of risk with Iran, oil shot up above 70 $ a barrel to stabilize now around 69.30. That’s 11 % over the low’s seen early June.

Before going to market talks, a few specific on some GCC countries.

Good economic news continue to filter from Saudi Arabia.

· GDP for Q1 2025 came out better than expected at +3.4 % y/y against expectations of 2.7 %. Again the non-oil sector is saving the day with +4.9 % y/y.

· The non-oil PMI jumped slightly in May to 55.8 from 55.6.

· Of great importance to the markets we follow, credit growth is accelerating to a 4 year high in April to 16.5 % y/y from 16.3 %. In the first 4 months of 2025, credit grew by 5.8 % compared to 3.9 % last year. The private sector dominates ( 93 % of total) , growing by 15.1 % y/y and 5.7 % year-to-date. Personal loans were up 10.4 % y/y.

· Deposit growth is lagging behind at +9.5 % y/y and 4.3 % year-to-date. So we will understand that the loan to deposit ratio is going through the roof at 111 %.

· New home lending was up 24.8 % in the first four months of 2025 to a total 698.9 bn SAR

Oman, the IMF was visiting recently and complimented Oman on its strong momentum . Despite lower oil prices and volumes, GDP growth reached 1.7 % in 2024 from 1.3 % in 2023 and is expected to reach 2.4 and 3.7 % respectively for 2025 and 2026. The fiscal surplus will shrink in 2025 to 0.5 % of GDP from 3.5 % due to oil and public debt continues to fall in % of GDP to 35.5 % in 2024 from 37.5 % in 2023. China has a plan to build a 1 bn $ lithium battery plant in the Sohar Free Zone.

Kuwait, May’s non-oil PMI was slightly lower to 53.9 from 54.2.

You cannot really compare but in Kuwait, real estate sales hit a 5 month high in May with 367mn KD recorded, about 1.2 bn $. Sharjah in the UAE hit the 1.5 bn $ mark in May while Dubai saw 5.5 bn $ of transactions in the first week of May.

In short, macroeconomic data continue to be supportive in the Gulf. Some non-oil PMI’s were slightly lower as a result of the global environment but even with that, they would make the envy of many countries especially in Europe and with inflation contained.

Markets :

SAR :

· Up until yesterday, the SAR FX curve had been relatively stable over the past few weeks with the 1year FX trading 180-185 mid, about 48 pips over $ rates. There has been the usual liquidity taking at time from local names supporting the short end but nothing spectacular. Following last night and early morning news, the 1 year FX points jumped to 220 mid , a jump of 11 pips over $ to 59. It has eased a touch now but remains well above opening levels. More to come should someone pull the trigger.

· Coming back to the domestic liquidity situation , I refer here again to paragraph above, strong credit growth unmatched by deposit growth. So the funding has to come from somewhere. As the riyal is pegged to the US dollar, Saudi’s monetary policy follows US policy step by step.

· As you know, the SAR IRS market is mostly dealt as a spread over $. Since early 2023, the spread moved from an average of 70 to 90 in 2024 to be above 100 now. With higher spikes : 145 was seen in late 2024 and we had several days recently above 130, now 108. Even though the line officially for the government is to prioritize certain projects in the Vision 2030 Grand Master plan in light of reduced resources due to lower oil prices, financing demand will keep exceeding available resources and so should continue to put upside pressure on the spread.

BHD :

· Earlier in the week, the Bahraini dinar FX curve eased on higher oil prices, lower CDS prices, some demand for sovereign paper and a bit of feel good mood .

· 1year FX fell from 205 mid to a low of 175 yesterday under local selling pressure. Until it turned around this morning on regional escalation.

KWD :

· The Kuwaiti dinar is interesting as we said many times because it is the only GCC currency not to be pegged , hence it allows for a more independent monetary policy on the way up as on the way down. On top of it, local banks are only involved punctually in the forward market. The largest bank doesn’t really show any interest beyond a few weeks. And you have some large Islamic institutions. As commented by a good friend, follow the money.

· Up until recently, those Islamic names were traditionally givers of liquidity, recycling deposits and all. It seems that it is not so much the case anymore and they have started to be takers or at least not providers of cash.

· In the background, the probable but still to be announced debt issuances. So the market has corrected from a deep discount to the $. Remember at one time in Q4 2024, the 1 year FX KWD was trading at -800 ( 250 bps below $ ) whereas 1yr KWD offered rate was 4.3750 and 1 year SOFR around 4.28.

· Funding conditions tightened at time and the market has seen those Islamic names bidding more aggressively for both KWD and USD cash ( as high as 5 % on the 3 month). Shortage of cash in the past few days has pushed the KONIA ( Kuwait Overnight Interest Average Index) to 3.31 % yesterday on a volume of 679mn KWD whereas the norm is usually 2 % for volumes of 300-400mn. Bidders were reported to pay as high as 9 % in late morning.

· That in turn lifted the whole curve with short dated funding like 1D going as high as 3 to 5 fx pips per day from a “normal” - 1. More than 500 pips jump over $. The whole curve moved up, 3 month jumped from early week of -45 mid to +20 mid, the 1 year from -110 mid to -20 mid . An 84 bps jump over $ for the 3m and 26 for the 1year.

· Things have eased a bit today but as liquidity gets tighter locally, it seems it is now two steps forward one step backward until next move !

· Imagine what it could be when the MoF will start issuing and taking liquidity from the market. Even though they will issue in both hard and domestic currency , especially if they want to prioritize domestic investments, those dollars will have to find their way into Kuwait domestic market.

· For now, the most plausible explanation I have heard for the sudden move up : local institutions adjusting for their liquidity ratios, gaps and all.

· Looking at where the respective $ and KWD 1 year are , the fact that the 1year spread to $ is 20 below is not shocking knowing the lack of bridges. But as the KWD official rates didn’t match the Fed’s hike on the way up, they won’t match as well on the way down. So we ought to go back to the period where 1year FX was dealing over +300, 100 bps over $.

· Last , always seem to be a lag between 1yr , 2yr and 3yr. Obviously the 1year is more popular and liquid and interest diminish the further you go ; plus when you have to exit against your terms , spreads will be much wider , but 1yr*2yr at -50 and 2yr*3yr at -150 seem inconsistent .

Last Morocco, beyond the normal-usual attractiveness of Morocco for foreign investors, manufacturers and all, it is summer season : the Moroccan dirham is dealing close to the bottom of the bands , -5 % : the currency is at its strongest. Not there yet, but very close. Always thought that it was better in the offshore to be long the local currency and earn some positive carry. If one is lucky to deal at just the mid on the 3mth, you might get 2 % over the $. There isn’t room for more appreciation though. On the other side, if you are hedged, you will get positive carry on the $ versus the Euro !

Thank you

DC