Middle East Fx , June 20th 2025,

Saudi FX curve remains supported ; other GCC's on the side line . Kuwait, the Central Bank is finally issuing 500mn KWD of 1 year paper.

Welcome to MENA MARKET LAB !We aim here to bring you regular updates on factors and events impacting financial markets in the Middle East and North Africa region with an accent on foreign exchange and rates.

We also aim to bring reflections on certain topics and subjects, close to recent events, which we think are worth stopping on .

Also, in the finance industry, monetization is “ the “ word ! So it is time for me to jump the bandwagon. If there is some appreciation in the time and information provided in those posts, then material recognition is fair. I am introducing a paid subscription. I am still figuring how it works so please be patient . It will start with next post !

Thank you for your attention !

In an ideal world, skiing in Iran, Dizin ski resort, Alborz province , 70km north Tehran.

Saudi FX curve remains supported ; other GCC’s on the side line . Kuwait, the Central Bank is finally issuing 500mn KWD of 1 year paper.

First,

State of mind ! Back in 1986, Bibi Netanyahu was Israel’s ambassador to the UN. He published the proceedings of a conference held in Washington under the title, “ Terrorism, how the West can win !”. In short, the book was fostering the impression that Israel’s enemies were also America’s, that the Arabs who used violence against Israel were terrorists, that countries who sponsored violence against Israel were terrorist states, and that brute force against them was not only legitimate but desirable. “ if a government has harboured, trained and launched terrorists, it becomes a legitimate object of military response !” . At least we cannot say that Netanyahu is not consistent over the years.

If there is one constant with Israel is that despite their military prowesses they have a problem with the political reading. They misread the US in the 1956 Suez war, they embarked in the Six Day war in 1967 with no political objectives, they mostly improvised after the second day of the war. They thought to eradicate the West Bank issue by invading Lebanon in 82, they only made the Palestinians stronger internally and got the intifada in 1987 , plus Hamas and Hezbollah . And they initiated the Iran Contra affair in the mid 80’s : supplying weapons to Iran and using the proceeds to support the contras in Nicaragua with the US in between , which the US Congress had specifically forbidden. They didn’t see the first intifada coming ( nor Arafat ). By trying to weaken the PA, they strengthened Hamas. Sharon , the man behind the invasion of Lebanon , sparked the second intifada with his visit to the Temple Mount in early 2000’s. And more. What will it be this time ?

Two potential winners in all this : Putin ! After all , he just trying to get back what he thinks is his and many believe he has been provoked. If the US intervenes in Iran, that will put them on par with Vladimir.

And China : while Russia, Iran, Israel and the US are deplenishing their stocks of missiles, bombs, drones, China is selling to many the components to manufacture them ! Plus a lot of soft power !

Now,

GCC wise, we can again brush aside local news even though they are positive .

· The UAE now ranks 10th in the world as a leading destination for FDI’s. In 2024, it reached 45.6 bn $, up 48 % from 2023. Keep in mind that the UAE’s population is just 10 million.

· Real Estate markets across most of the region continue to perform very well .

· Inflation edged a bit lower in Saudi Arabia to 2.2 % y/y in May from 2.3 % .

· Saudi Arabia, credit growth accelerates to a 4 year high.

· UAE posts 4 % GDP growth in 2024 .

Obviously the focus of regional financial markets is not there but in whatever Israel , President Trump and Iran decide to do and how they will react.

Oil was peaking towards 77.5 $ for Brent yesterday as uncertainties and confusion on what Trump might do or not. Some news reported Trump had approved plans to strike but was pondering. Then he said he would decide within two weeks. So oil eased lower below 76 . I am still surprised how the market could dip to 70 $ on Monday just 2 days in the conflict !

FX Market wise, there has been some pockets of activity this week, a bit of directional and spread based but most are just watching from the bench !

From Oman to Bahrain, the little bit of pressure seen last Friday has quickly vanished : I guess at the end it is very much a case of “ something big just happened, it can be consequential, here is my run and prices, high and wide , be my guest “ . The market didn’t buy into that and quickly settled back lower.

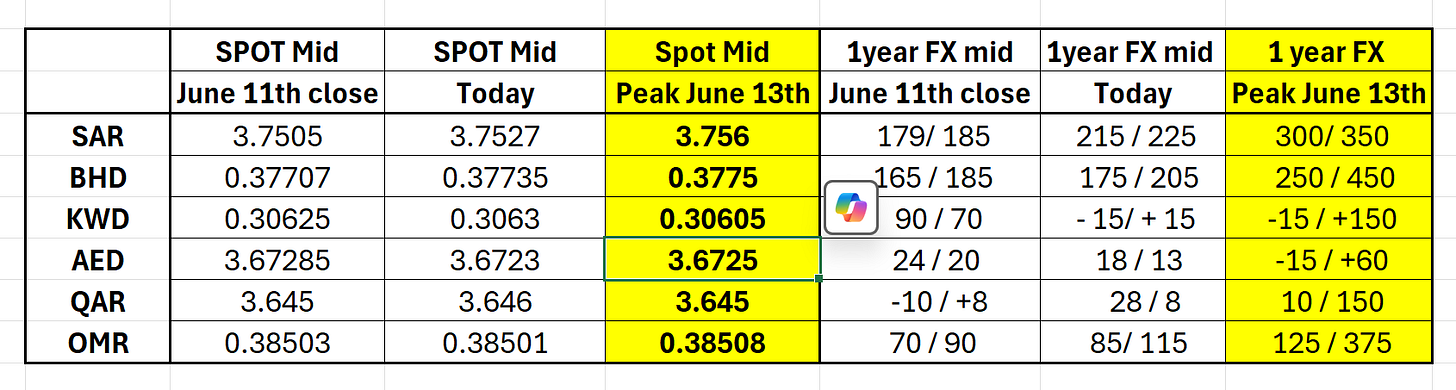

If you look at the table below, forward and spot SAR remain a bit higher because it is the easiest and most liquid proxy to play for regional uncertainties. But most are probably just looking for a small rally to sell and go short outright of $ and earn a potential higher carry. As pointed last week, selling spot SAR above 3.7550 and 1 year above 300 is attractive ! We also know there are price levels a bit higher that will attract selling interest from local institutions.

Recent events have also pushed the Sar IRS curve a bit flatter : whereas the 5*10 year box was at -5 or below ( spread wise ), it is ticking towards Par. Firmer SAIBOR and regional background.

We cannot completely exclude a worse case scenario where Iran would mine the Strait and or launch drones/missiles across the Arabian Gulf / Persian Gulf but Iran and the Gulf countries , especially Saudi Arabia have been working over the years to improve relationships . Some have been intermittent mediators for a long time like Oman. And the UAE is where business is conducted. So maybe it will be left to just that !

une 11th is a day before rumours started to spread that Israel would attack and they did in the early hours of the 13th .

And as now a regular feature, Kuwait . The FX forward curve remains close to its highs. And that is because the Central Bank of Kuwait acting for the Ministry of Finance is finally issuing local currency debt.

Although we haven’t seen the circular, the CBK will issue 500mn KWD , 1 year at 4.3750 %, half conventional, half Islamic !

So finally after many months, they have finally pulled the trigger and go back to the market for the first time in 8 years. More will follow, they will also issue in hard currency but this is the first step. Hence the reason why the 1year FX is around Par now !

I do not have a settlement date nor more details on the circular sent to local banks. Funding wasn’t particularly tight before the news started to filter yesterday morning. Let’s see how things go from there.

In short, it seems that :

· On the Saudi, market is positioned for the curve to move up but will be quick to take profit if it rallies. They won’t be looking for a home run ! Only first base !

· On other GCC currencies, except Kuwait, very much on the side line .

· And for the Kuwaiti Dinar, is it finally the first move that will take the curve back in positive territory ?

Thank you

DC