Middle East FX, Kuwait, April 23rd 2025,

Kuwait’s forward curve, one step closer to parity with the US dollar !

Welcome to MENA MARKET LAB !

We aim here to bring you regular updates on factors and events impacting financial markets in the Middle East and North Africa region with an accent on foreign exchange and rates.

We also aim to bring reflections on certain topics and subjects, close to recent events, which we think are worth stopping on .

Thank you for your attention !

Beautiful coal mine.

Kuwait’s forward curve, one step closer to parity with the US dollar !

Going into the future ! The Trump administration has been busy putting a halt to several offshore wind projects that were approved or supported by the Biden administration. At the same time, April 8th, he signed an executive order to reinvigorate the beautiful clean coal industry. Less than 46000 Americans work in the coal industry of which 60 % in underground mines. How many jobs will be created to make it meaningful ! At the same tine, DOGE inflicted severe cuts to agencies tasked to ensure miners’ health . Probably good for some’s bottom lines. But again, while China’s President Xi Ping has been pushing for long term plans to develop key industries for the future, US President dreams to go back to the 19th century . Who will be right..

Can’t have it all ! Wall Street was showing a happy face after Trump’s elections, predicting a tidal wave of investment banking deals. Hundred days later, the mood is darker and those deals will not come for now , on the contrary, all stay put. On the other side, a large jump in volatility is pushing counterparties of all sides to increase hedging and top banks are ripping it with a big jump in market divisions’ revenues.

Past few days were showing again decent swings up and down on equities, FX and all.

Closer to us, GCC markets have been fairly subdued.

With two exceptions :

The smaller one : Oman ! With oil prices rebounding over 68 $ a barrel and a somehow less stressing outlook ( after the initial shock, nerves get steady again), the 1 year FX Forward points on OMR dropped from a recent high of 85/115 ( fx pips) to 10/40 now, back to where it started !

The bigger one, Kuwait !

But for different reasons.

Up to now several points had been affecting the Kuwaiti dinar and its FX Forward curve :

· The dinar is not a pegged currency unlike other GCC currencies but is linked to a trade-weighted basket of currencies;

· Because of the above, the Central Bank felt the right not to follow the FED whenever they cut or increase rates. Hence in the upward cycle, they lagged behind and since September 2024, while the Fed cut 3 times for a total of 100 bps, the CBK cut just once 25 bps.

· Recently was approved a long awaited Debt Law allowing for the issuance of up to 30 bn KD up to 50 years, the Law finally approved after much delay since the previous one expired in 2021. That law with the potential effect of sucking up excess liquidity in the market.

· And we are still waiting for a Mortgage Law.

· With the interest gap narrowing between the US dollar and the Kuwaiti dinar, spreads on the Forward curve had already narrowed quite a bit , from a low of -800 fx points for the 1 year Fx swap to -180 mid on Monday even though there was a spike to -125 in the early days following “ Liberation Day “. That narrowing on the 1 year was equivalent to 2 % jump in the spread between Kwd implied and the US curve ( from -2.57 % to -0.57 %).

· On the spot , the weakness of the USD and the rebound of the Yen led the CB to let the dinar weaken : the gap fixing-theoretical price moved from -130 fx points early January to +230 fx points at the most , over 1.2 %, to around +210 now.

Yesterday saw a flurry of activity on the spot and forward side .

· One of the main factors behind the tightening of the curve till now was that locals were not giving liquidity but on the contrary, as some Islamic names, taking it. Some Islamic names as we mentioned some months ago had usually been givers of 3month and above in decent sizes as an opportunistic recycling of free deposits even at very low levels. This seems to have dried out and even reversed.

· Much talks have been made recently of Warba Bank taking over Gulf Bank locally.

· That same bank, Warba, has recently announced and opened a capital increase subscription for existing shareholders and the public : they intend to issue over 2 bn shares at 200 fils, raising over 436mn KD ( 1.4bn $).

· The subscription period will end on May 12th 2025 while the exercising and the subscription period to allocate Pre-emption Rights closes tomorrow !

· Local markets became super tight with locals having no liquidity to spare. Keep in mind that local banks do not actively support the dinar market for offshore counterparties. If one international finds itself long of cash on the Nostro, most likely he will have to sit on it. Covering short positions is marginally easier and one has to count on the offshore markets where only a handful of counterparties have access to local liquidity , hence the importance to maintain cash lines and to recognize the fact that Kuwait has a rating of AA- and its sovereign wealth fund sits on 1 trillion dollars ( and Saddam is long gone ) : embrace reality, Kuwait is a good risk.

· Funding which had been in negative territory for ages swung in positive , the whole short end moved up over Parity with the 1 week trading at +7, the 1 month shown +10/20 while the 1 year dealt as high as -70 and most likely higher behind closed doors.

· -70 on the 1 year means that the spread KD over $ narrowed to just -20 bps from -60.

· Longer maturities like 2 year also moved up getting to 250/200.

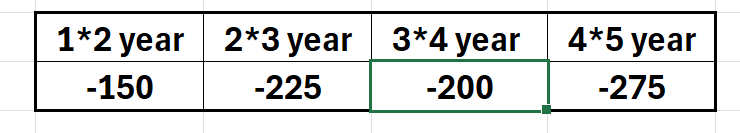

· A bit difficult to assess correctly the forward-forward spreads on extended tenors as it widens and doesn’t deal that much . Below is an approximate reading.

· Finally, funding tightness has pushed some to seek the missing funding via spot transactions and this has pushed the spot 50 fx points below fixing.

On the wider frame :

· The Debt Law has been passed but so far market has seen any issuances that could absorb liquidity,

· Some assumptions that should the Fed cut rates 2 or 3 times as some are expecting, CBK would only follow once, hence contributing to send the official gap in positive from negative. But listening to Fed Chair Mr Powell, those rate cuts will probably not come any time soon.

On the shorter frame :

· If the current tightness is linked to Warba Bank’s issuance, then it won’t last and liquidity should come back just as a gap of 50 points below fixing ( spot ) makes it an attractive place to buy USD against KD.

· Even if paying +7 for 1 week funding might seem expensive, it certainly makes more sense that to pay -80 or -70 on the 1 year if it gaps back lower towards -150.

· Markets had a bit of two way trading this morning, first easing down and then some paying flows. The window for pre-emption of Allocation Rights is closing April 24th, means the last day to get liquidity for that date is tomorrow but realistically, on a liquidity perspective, that was yesterday, April 22nd for spot value 24th.

· Some have used the 50 pips discount fixing to buy some USD spot ; gap has already narrowed even though the CB has reduced by 20 fx points the official gap ( theoretical price-fixing ).

Going forward,

· I still think Kwd curve will trade over the Usd curve and will see the whole curve back in positive territory. Looking at a 5 year chart, we had a cruise altitude level of around +200 fx pips for the 1 year Fx for quite a few years, until early 2022, corresponding to about 65 bps over Usd.

· But it is a step by step progress : we come from -800 last November . Recently the market jumped from -300 ( 1 year ) to -125 in a few sessions to ease back to -190 ; then now to -70 to be back around -100.

· On Warba Bank, the allocation will happen within 5 working days after the closing of the first and second subscription periods and the return of extra allocation funds within 5 working days of the allocation period.

· So most likely, extra liquidity taken will come back to the market and push the curve back down .

· Until uptrend resumes. With new issuances .

· Good to buy spot as those discounted levels .

Thank you

DC